Take Control of Benefit Costs, Risks, and Hassles

Are your health and welfare benefits ransacking your budget with high claims and even higher rates? Do your employees understand how to use their plans, or are they driving up costs? Are you weary of the benefits administration slog that zaps your HR resources? Will one ACA compliance slip-up bring the government, audit in hand, to your front door? You can stop worrying.

We have the solutions to streamline your benefits processes. We have the cure for your ACA, HIPAA, COBRA, GINA and ERISA compliance and indigestion. We have the ability to education your employees. We know how to structure compelling voluntary benefits packages. We offer the very best health and wellness plans. We are your ideal group benefits specialists.

Our Comprehensive Benefits Platform Provides:

Can Your Benefits Perform Better?

Maybe your program is ransacking your budget with high claims and even higher rates. Or your employees don’t understand how to use their plans and are driving up costs. Or you’re weary of the administration slog that zaps your HR resources. Or you’re worried that one ACA compliance slip-up will bring the government, audit in hand, to your front door.

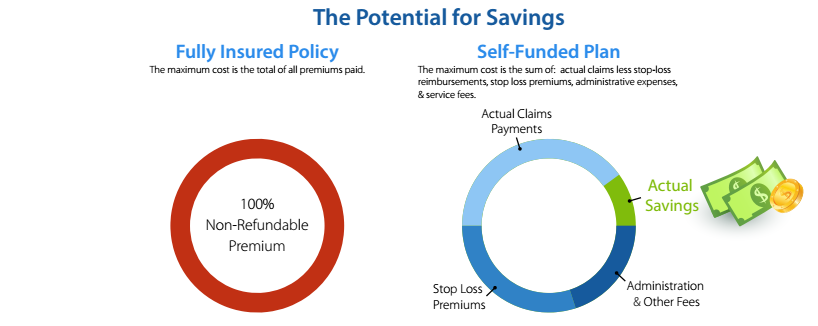

Why Self-Funding Works?

The Incredible Benefits of Self-Funding

More employers are discovering that self-funded plans are exempt from a number of ACA regulations that fully insured plans must meet.

• Self-funded health plans are not subject to medical loss ratio requirements.

• HHS – issued rules on “essential health benets” do not apply to self-funded health plans.

• Self-funded plans escape the health insurance industry fee, expected to be 2%-2.5% of premium in 2014, 3%-4% in future years.

These exemptions allow employers that choose self-funding to custom tailor their health benefits to the needs of their workforce and design plans that promote both wellness and responsible spending.

Greater Flexibility, Lower Fixed Costs, & Total Cost Transparency

Plan Design Flexibility & Total Transparency Create the Potential for SAVINGS!

Two of the best features of self-funded plans are access to meaningful information on claims and costs, seldom available in a traditional, fully insured environment. When stop loss coverage is secured to limit the employer’s overall exposure for claim costs, both on a specic and aggregate basis, the plan retains the savings when claims are lower than expected.

Expert Administration

As a full-service Third Party Administration (TPA) rm, we handle employee enrollment, claims administration, and management information reporting. We also provide ID cards, plan booklets, call center support and easy, secure access to online and mobile tools – everything to make your plan operate smoothly.

Population Management

We use predictive modeling technology to weigh complex variables and identify the factors driving cost increases.

Health risk assessments, disease management, and population management help improve the health of plan participants, often helping self-funded plans avoid costly future claims.

Not Just for Big Companies

While self-funding is more common among firms with groups of 100 or more, many smaller organizations are exploring it’s advantages. The only way to determine if self-funding is appropriate is to review a current employee census, premium rate history, or actual claims experience if the data is available.

PEO Overview & Options

A professional employer organization (PEO) provides comprehensive HR solutions for small and mid-size businesses. Payroll, benefits, HR, tax administration, and regulatory compliance assistance are some of the many services PEOs provide to growing businesses across the country.

With Strategik Partners serving as your PEO consultant, your company will have a statistical advantage:

- The current size of the PEO industry is between $136 and $156 billion, as measured in gross revenues

- PEO’s provide services to between 156,000 and 180,000 small and mid-sized businesses, employing between 2.7 and 3.4 million people

- There are between 780 and 980 PEOs currently operating in the United States. They employ between 21,000 and 27,000 people internally

- The PEO industry has grown significantly. In each of the last 30 years, the industry has added, on average, roughly 100,000 worksite employees and 6,000 net new clients. For perspective, that means that every five years, the PEO industry has added the employment equivalent of the entire utilities industry in the United States

- The estimated 2.7 to 3.4 million employees who benefit from PEO services is a number larger than the size of the entire agriculture/forestry industry in the United States (and close to the size of the federal government, the education sector, or the information sector), based on data from the Bureau of Labor Statistics (BLS)

THREE WAYS YOUR SMALL BUSINESS BENEFITS FROM A PEO

GROW 7-9% FASTER

Since December 2004, employment at small businesses using PEOs has grown more than 7 percent faster than at small businesses overall, according to the Intuit Small Business Employment Index.

HAVE 10-14% LOWER EMPLOYEE TURNOVER

The average overall employee turnover rate in the United States is approximately 42 percent per year, based on 2012 data. It is 28 to 32 percent for companies that used PEOs for at least four quarters.

BE 50% LESS LIKELY TO GO OUT OF BUSINESS

Businesses that use PEO’s are approximately 50 percent less likely to fail (permanently go “out of business”) from one year to the next when compared to similar companies in the population as a whole. The overall business failure rate among private businesses in the United States as a whole is approximately 8% per year, based on 2012 data. It is approximately 4% per year for those companies that used PEO’s for at least four quarters.

THE PEO ADVANTAGE

PEO’s enhance your business by providing a variety of services related to human resources. In addition to those types of services, PEO’s can most impact your business by taking care of paperwork and providing regulatory compliance assistance. PEO’s are currently helping businesses across the nation to improve productivity, increase profitability, and focus on their core mission.

Through a PEO, the employees of small businesses gain access to big-business employee benefits such as: 401(k)plans; health, dental, life, and other insurance; dependent care; and other benefits they might not typically receive as employees of a small company.

Request a Call Back

Would you like to speak to one of our consultants over the phone? Just submit your details and we’ll be in touch shortly.

For Businesses: Do you have questions about how Strategik Partners can help your company? Send us an email and we’ll get in touch shortly. We would be delighted to speak with you.