What is the ACA?

The Affordable Care Act (ACA), more generally referred to as Obamacare, is the health reform legislation passed by the 111th Congress and signed into law by President Barack Obama in March 2010.

The legislation includes a long list of health-related provisions that began taking effect in 2010. Key provisions are intended to extend coverage to millions of uninsured Americans, to implement measures that will lower health care costs and improve system efficiency, and to eliminate industry practices that include rescission and denial of coverage due to pre-existing conditions.

The ACA requires large employers to provide a qualified level of insurance coverage. This requirement is enforced by the number of full-time equivalent employees (those who work 30 hours per week or more). However, part-time employees are also part of the calculation, as a fraction, and are included in the overall total.

How does the ACA apply to your business?

ACA enforcement for companies with 100+ full-time employees and equivalents (FTEs) began on January 1, 2015

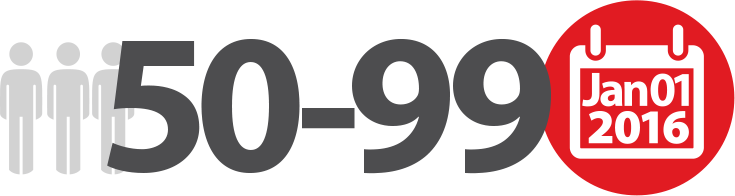

Companies with 50-99 full-time employees and equivalents (FTEs) will need to be compliant by January 1, 2016

If you have 49 full-time employees and equivalents (FTEs) or less, you are not impacted by the ACA

Strategik Partners' Solution for the ACA

Meeting the requirements of the Affordable Care Act (ACA) can be a daunting task. Strategik Partners now offers a solution to help you understand the complexities, avoid noncompliance fines and reduce administrative work.

Monthly reporting of full-time employees and equivalents (FTEs)

Allows you to calculate the total number of full-time employees and FTEs you have over a designated measurement period in order to determine if you are an applicable large employer required to provide employee health insurance coverage.

This report will list employees’ total paid and unpaid hours (including work, sick, personal and vacation) and average hours per week.

Year-end completion and electronic filing of 1094-C and 1095-C tax forms*

Strategik Partners can provide you with the best overall options for payroll, HR, and PEO, as well as handling end of year tasks. Our partners eliminate the need for you to manually process and file forms, or even produce the forms needed for distribution to your employees. Our partners can handle all such tasks on your behalf.

*Employers with 50-99 full-time employees and FTEs are not required to provide health coverage to eligible employees until 2016, but are required to file Forms 1094-C and 1095-C for 2015.

Learn more about ACA

If you are an existing client of Strategik Partners, please contact your account manager. If you are new to Strategik Partners, please feel free to fill out the form below and a representative from our team will be in touch with you very soon.

Request a Call Back

Would you like to speak to one of our consultants over the phone? Just submit your details and we’ll be in touch shortly.

For Businesses: Do you have questions about how Strategik Partners can help your company? Send us an email and we’ll get in touch shortly. We would be delighted to speak with you.